【Column】Tax Considerations for Foreign Investment in Japanese Real Estate

Japanese real estate has become even more attractive for international investors due to the steep depreciation of the Japanese Yen and competitive real estate price in Japan. Real estate is often acquired through specific investment structures, some of which are unique to Japan.

This article briefly outlines the most common investment structures considered by foreign investors wishing to acquire Japanese real estate. The tax consequences of each structure are very specific and should be reviewed on a case-by-case basis with a tax specialist. The “TMK” and the “GK-TK” structures are unique to Japan, there are no perfectly analogous structures in other developed legal systems.

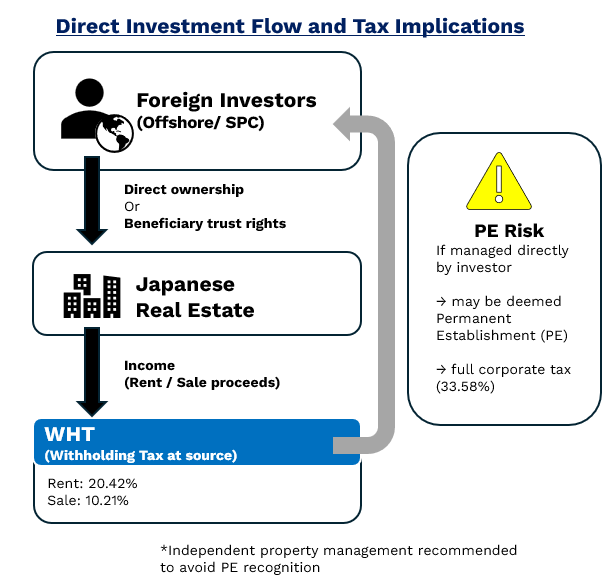

Direct Acquisition

Overview

In a direct acquisition, an offshore foreign investor directly or through an offshore special purpose company (SPC) (in both cases, "Investor[1]" but this article will be focused on the case where the Investor is an offshore entity) acquires either direct ownership of the target property or beneficiary trust rights over the property (after the ownership has been acquired by a Japanese trust bank). Generally speaking, there are no restrictions on real estate foreign direct investment in Japan and direct offshore acquisitions by Investors are common.

[1] We assume in this memo that the Investor has no presence in Japan (no permanent establishment).

Incorporation and governance

Since the Investor is located offshore and no structure is created in Japan, Japanese laws regarding the creation and governance of Japanese legal entities do not apply.

TAX

Rental income from the Japanese property will be subject to withholding tax at 20.42 per cent when paid to the Investor. The withholding tax rate will depend on the tax treaty applicable to the Investor. Capital gains from the sale of the real estate or beneficiary trust rights in Japan will be subject to withholding tax at a rate of 10.21 per cent to the extent the purchaser is a resident of Japan. The current rate of capital gains tax is 23.2 per cent for the Investor.

The withholding tax will be deducted from the capital gains tax (in other words, the maximum taxation will be 23.2 per cent). The Japan–Singapore tax treaty does not provide an exemption for capital gains in Japan and this is the case for most treaties. Selling the offshore acquisition vehicle usually results in the same tax consequences as the direct sale of the real estate, but depending on the applicable tax treaty there may be a tax planning opportunity to minimize the tax burden in Japan.

The Investor is required to file (a) a notice with the Japanese National Tax Agency (NTA) within two months from the sale as well as (b) a tax return to declare the capital gains within two months from the end of the fiscal year of the Investor. Separately, the Investor should be careful to ensure that the Japanese real estate is managed by an independent third party to avoid the risk that the Investor is found to have a PE in Japan. If that were the case, rental income and other income derived from the real estate as well as capital gains may be taxed at an effective rate of 33.58 per cent. For larger investments, the use of one of the alternative structures below is a way to decrease the PE recognition risk.

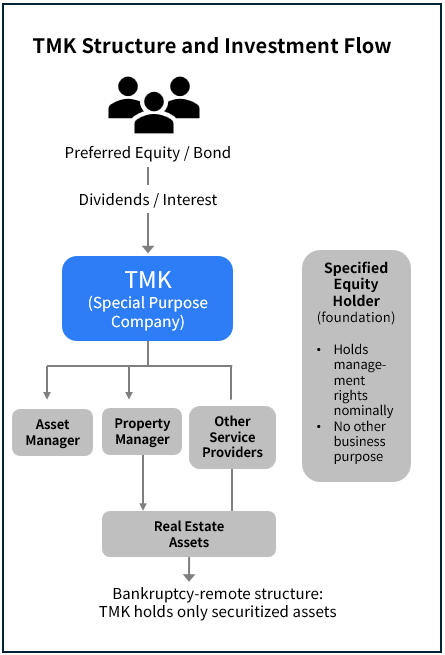

Tokutei mokuteki kaisya (TMK)

Overview

A tokutei mokuteki kaisha (which means "specifial purpose company", usually referred to by its acronym: TMK) is a special purpose limited liability company that was introduced in 1998 and can only be used for securitization of assets. The TMK allows the securitization of property rights by issuing asset-backed securities (shisan taio shoken) to investors, usually in the form of preferred equity or specified bonds. The TMK can also receive specified loans from lenders. Profits are distributed to investors by way of dividends on equity or interest on bonds, depending on the nature of the security issued to investors by the TMK. Lenders are usually remunerated with interests and have limited recourse against the assets of the TMK. The TMK is established as a bankruptcy-remote structure with its usually nominal specified equity (with management rights) being held by a foundation.

Incorporation of a TMK; filings for acquisition of assets

Because of its special role as an investment vehicle for securitized assets and preferential tax features, TMKs are subject to stringent regulatory requirements. In order for a TMK to acquire the target assets or to issue asset-backed securities, an asset liquidation plan (ALP) must be filed with the Financial Services Agency (FSA). The ALP should stipulate in particular:

- the proposed business period of the TMK;

- the maximum number and type of the rights to be associated with the asset-backed securities and specified loans of the TMK;

- a description of the TMK’s specified assets, the seller of the assets, and the timing of acquisition of the assets;

The ALP can be modified during the life of the TMK but all changes will notified to the FSA.

No minimum capital is required to establish a TMK (the specified equity is usually very small). Because the preferred equity and bonds issued by a TMK are considered securities under the Financial Instruments and Exchange Act (FIEA), the TMK must generally use a licensed securities broker or asset management company to contract with preferred equity holders and specified bond holders or to manage the funds collected from investors.

A TMK may be incorporated together with its specified equity holder within a week or two. However, preparing and filing the ALP takes approximately three months. This is the time required until the TMK can acquire the target assets.

Governance

The TMK only holds and disposes of real estate assets: all operations and management of the TMK’s assets, including solicitation for investment and management of invested capital, are outsourced by the TMK to outside service providers (asset manager, property manager, etc.).

The TMK has only two types of members (=shareholders):

i. specified equity holders, who hold specified equity (tokutei shussi); and

ii. preferred equity holders, who hold preferred equity.

There is usually only one specified equity holder. The specified equity holder has voting rights and nominally supervises the operations of the TMK but the specified equity holder is usually a foundation with no other purpose except holding the specified equity of the TMK. Preferred equity holders have preferred rights to receive the dividends and/or distribution of residual assets but they usually have only very limited voting rights.

A TMK must have at least one director (torishimariyaku) and one statutory auditor (kansayaku). The director is often an accountant who also acts as director of the specified equity holder. There is no residency requirement for the director and the auditor. In addition, if the TMK issues preferred equity, an external accounting auditor (kaikei-kansanin) is also required. Further, a TMK is subject to disclosure requirements regarding its assets to protect investors.

TAX

A tax qualified TMK may deduct dividends paid to its equity holders against its taxable income. This means that, in theory, if the TMK distributes all its taxable income, it will not have any income subject to corporate tax. The tax-conduit requirements of the TMK include in particular the following criteria:

- The TMK issues either:

- specified bonds of 100 million yen or more through a public offering;

- specified bonds to be held exclusively by qualified institutional investors (QIIs);

- preferred equity subscribed for by 50 or more investors; or

- preferred equity subscribed for exclusively by QIIs.

- The TMK must conduct its business in accordance with its ALP and not engage in any other business or hold any assets except as specified in the ALP;

- The TMK must distribute over 90 per cent of its annual “distributable profit” as dividend. The “distributable profit” amount is based on income determined in accordance with J-GAAP.

If the TMK is not tax-qualified, distributions to preferred equity holders will be after tax and will be taxed on corporate income at the effective tax rate at 33.58 per cent.

In all cases, distributions to preferred equity holders are still subject to Japanese withholding tax at a rate of 20.42 per cent, subject to exemption or reduced withholding tax rates under applicable tax treaties. In recent years, under the BEPS initiatives, many tax treaties have been revised to deny treaty benefit when a pay-through treatment is available under the domestic law of one contracting party. However, the Japan-Singapore double income tax treaty does not yet include this clause which creates concerns for Japanese tax authorities in light of the recent trend to use a TMK structure with a Singapore investment vehicle. The tax environment should therefore be monitored closely.

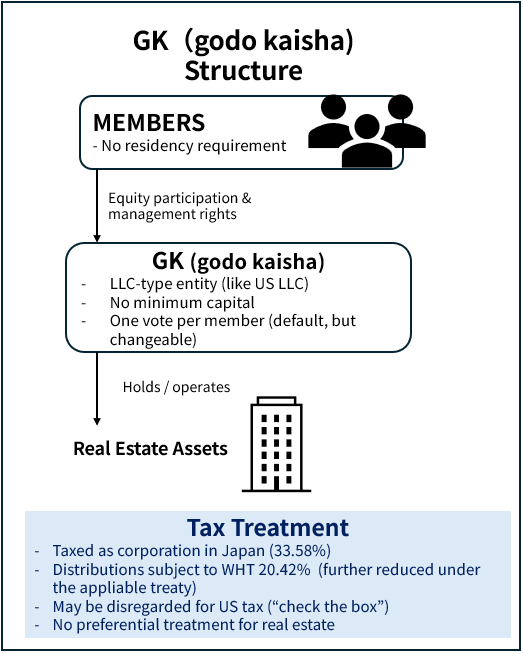

Godo kaisha (GK)

Overview

A godo kaisha (GK) structure is similar to a limited liability company under US law. It is easier to incorporate than the traditional corporation (kabushiki kaisha or KK) and also easier and cheaper in terms of corporate governance, since there are few formal corporate governance requirements to be observed.

Incorporation

No minimum capital is required. The GK may be incorporated within a week or two (if the incorporation documents can be executed reasonably rapidly).

Governance

Contrary to the KK, the GK does not issue shares and is held by "members". Members are both the holders of the equity of the GK and if they are granted executive powers (if there is more than one member, some members may be non-managing members while others are managing members), the managers of the GK. Members do not need to be resident in Japan. If the managing member is a legal entity, it must be represented by a physical person, called the executive manager. If there is more than one managing member, each managing member can represent the GK. However, a representative member may be appointed from among the managing members. Regular general meetings of members are not required.

The GK’s corporate name, its business purposes, the amount of its stated capital, the names and addresses of its members and their executive managers are publicly available information.

Similarly to the KK, the liability of the member of a GK is limited to the amount of its equity participation.

Contrary to the KK, decisions among members are taken not on the basis of equity participation but each member has one vote (although the different structure can be adopted if so provided in the Articles at the GK).

Tax

The GK is popular with US parent companies because while the GK is taxed in Japan as an opaque entity on its income, a GK can be a disregarded entity (referred to as “check the box”) for US tax purposes.

The GK’s income is subject to local and national corporate tax at the effective tax rate of 33.58 per cent. A distribution of dividends by the GK is subject to withholding tax at the rate of 20.42 per cent subject to exemption or reduced tax rates under applicable tax treaties.

The GK does not enjoy preferential tax treatment on real estate investments as does the TMK or GK-TK (discussed below) and distributions from a GK to its parent company may be subject to withholding taxes.

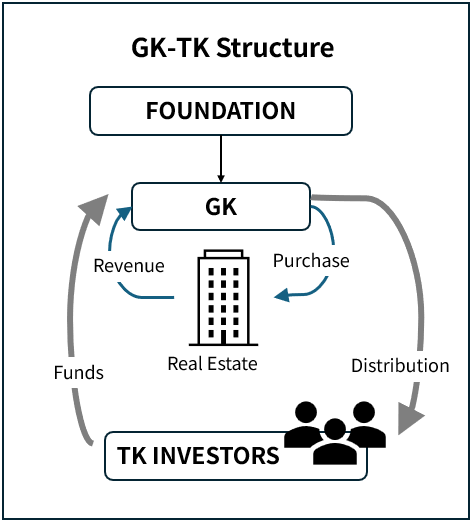

GK-TK

Overview

This structure includes (i) a GK property holding company together with (ii) investors, having executed a so-called tokumei kumiai (silent partnership often referred to by its Japanese acronym: TK) agreement with the GK. A TK is a form of partnership established contractually between the TK investors and the GK acting the TK operator. In a GK-TK structure, the GK is established as a special purpose company whose sole purpose is to hold real estate assets. In a GK-TK structure, the GK is similar to a general partner and the TK investors to limited partners, in a limited partnership under US law. Under the TK agreement, the investor provides funds to the GK in exchange for the GK’s obligation to distribute a share of the profits arising from the GK’s business to the investor. The investor’s role is limited to that of a passive investor with contractual rights under the TK agreement. The TK investor’s liability is, accordingly, limited and the investors are not liable for obligations arising from the GK’s business exceeding the amount of their respective contributions.

Incorporation

The incorporation process for a GK is straightforward as discussed above. Once the GK is formed, the TK investors will enter into the TK agreement with the GK. The TK agreement may be signed any time after the GK is formed and the GK and investor wish. The TK agreement is not filed or made publicly available.

For bankruptcy-remoteness purpose or to avoid the investor being seen as involved in the management of the GK, the GK may often be held by a foundation whose sole purpose is to be hold the equity of the GK.

Governance

The same simplified governance rules for ordinary GKs also apply to the GK in a GK-TK structure. In addition, since the TK investors are passive (silent), the GK is the only party that is permitted to be active in the management and operations of the GK business.

In order for a GK (acting as a TK operator) to solicit investments and manage invested capital (which are treated as securities under the FIEA), the GK must either be licensed under the FIEA or fall within a permitted exemption. One exception to this requirement is if the TK investors include at least one QII and less than 50 non-QIIs, in which case only a simple notice filing of self-offering is required. To avoid this permit or filing obligation, a GK can outsource the investment solicitation and management to a licensed securities broker.

A separate real estate permit is required under the Real Estate Specified Joint Enterprise Act for a GK-TK to solicit, invest in direct real property interests and distribute profits therefrom, unless certain requirements for an exemption are met. If the GK holds trust beneficiary rights (instead of real estate ownership rights), such permit is not required.

Tax

Similar to the TMK, the GK can deduct distributions to the TK investors against the GK’s income. To qualify for this treatment, the TK investor must not be involved in the management of the GK, directly or indirectly. In practice, if the GK is really a vehicle, its assets are managed by a third party which may be related to the TK investors but this structure needs to be carefully calibrated and reviewed to ensure that the "silence" requirement is met.

Distributions of profits (dividends) may be treated as deductions against corporate income at the GK level but such distributions are still subject to withholding tax at 20.42 per cent. Generally, there is no tax exemption or reduction of the withholding tax under recent double tax treaties.

| Structure | Key Features | Tax Treatment | Advantages | Disadvantages |

|---|---|---|---|---|

| Direct Investment | No Japanese vehicle required | Withholding tax on rental income and capital gains; PE risk if not managed externally | Simple, no setup cost | Investor directly liable for Japanese tax |

| Tokutei Mokuteki Kaisha (TMK) | Regulated SPC, requires FSA filing | Dividend deduction possible; 20.42% WHT (treaty reduction possible); BEPS restrictions | Corporate tax can be minimized | Heavy regulation and costs |

| GK-TK | GK (LLC) + TK agreement | Deductible distributions; 20.42% WHT; generally no treaty reduction | Flexible, quick setup, low cost | Must meet “silence” test; generally no treaty relief |

(Written by: Makiko Kawamura, Jean-Denis Marx)

*This newsletter is provided for educational and informational purposes only, and is not intended and should not be construed as legal or tax advice.

For more information and questions regarding this column, reach out to us.

Tokyo International Law Office

makiko.kawamura@tkilaw.com

Tokyo International Law Office

jean-denis.marx@tkilaw.com